It is easy to get behind in today’s fast paced real estate environment

- No Global Cashflow Statement

- Disorganized Financials

- Overwhelming Paperwork

- Multiple Bank Partners

- Staffing Fluctuations

- Missed Opportunities

TCRES creates a tailored solution for its clients

Comprehensive Portfolio Management Services

Polish:

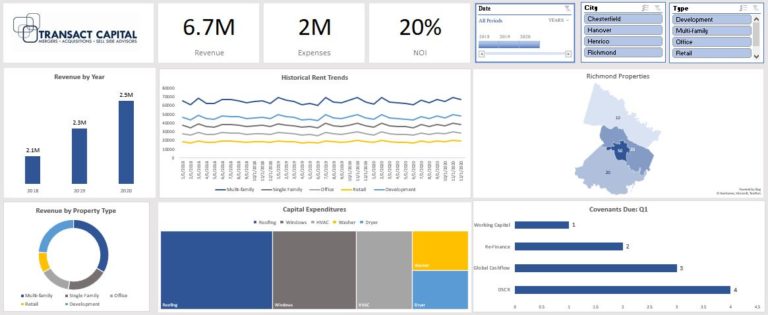

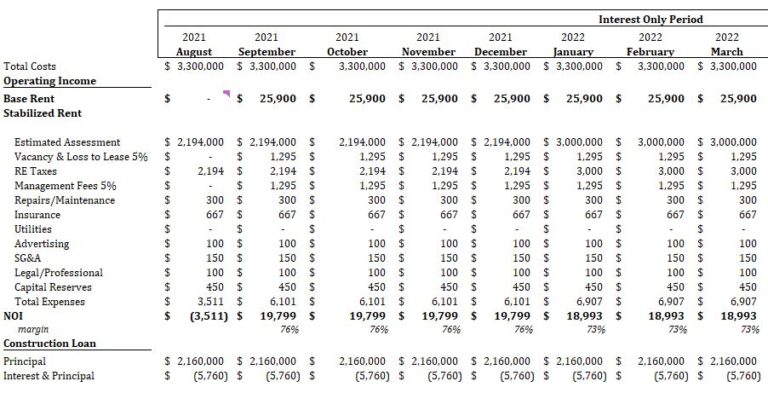

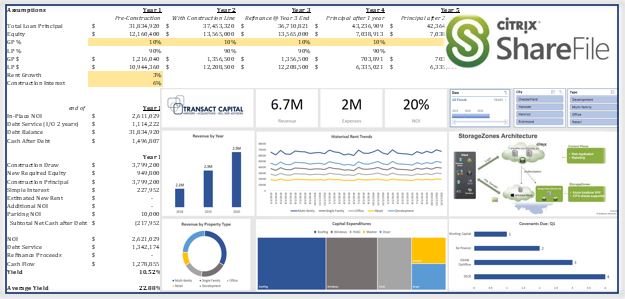

- Consolidated financial reporting

- Dedicated analyst support

- Global cashflow analysis

Pitch:

- Portfolio refinance

- Debt and equity

- Acquisition Support

Perform:

- Covenant calculations and monitoring

- Performance reporting

- Advisory referrals

Monthly Analysis Reports | Increased speed to market | Cashflow Maximization

Capabilities at a Glance

Contact Matt and Luc Today:

Matt Kanne

Executive Vice President

- Matt@TCRES.com

- 804.612.7104

Matt spent the last two plus years handling a variety of transactions for Transact Capital Partners in the lower middle market, including the real estate related sales, valuations, and strategies. Prior to his joining Transact, Matt worked as a real estate portfolio manager at Atlantic Union Bank (formerly Xenith Bank). There he gained wide exposure to the commercial lending environment including underwriting, structuring terms, and managing client expectations.

Luc Maestrello

Analyst

- Luc@transactcapital.com

- 804.612.7121

Luc is a first-year analyst with previous real estate experience, specifically in real estate analytics. Before joining Transact, Luc worked for Twiddy and Company, an Outer Banks real estate group, across their strategy and finance divisions. There he provided data and financial modeling as well as assisting in new operational ventures. Luc also has experience in startups, having served as CFO of a local Richmond company.

Luc attended Hampden-Sydney College and obtained his B.S. in Business Economics and Biochemistry/Molecular Biology. He also went to the Raymond A. Mason School of Business at William and Mary, where he earned an M.S. in Business Analytics and an MBA with a concentration in Finance.