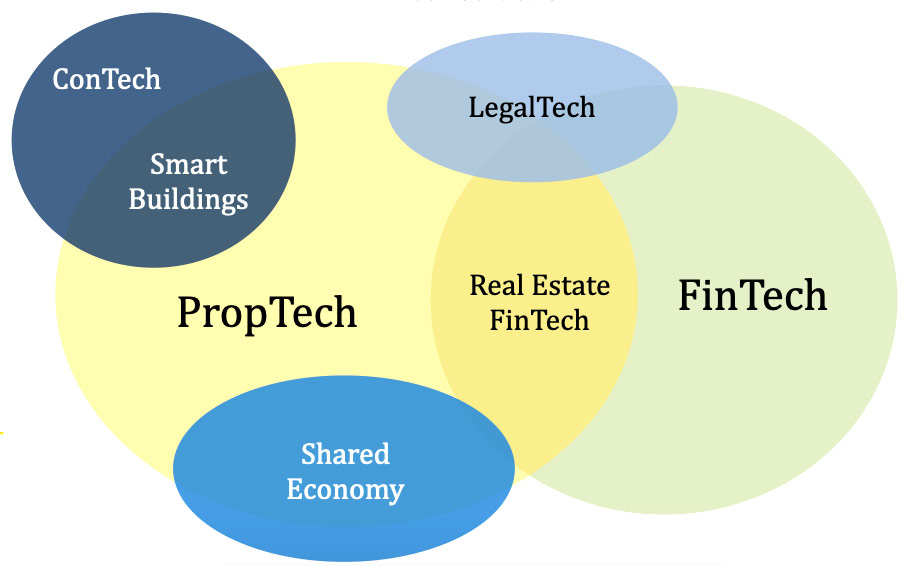

Transact Capital specializes in Property Technology within the M&A market. Transact’s deep expertise in both technologies focused M&A and Real Estate uniquely positions us to serve alongside company owners as we guide them through the M&A process.

Industry Overview:

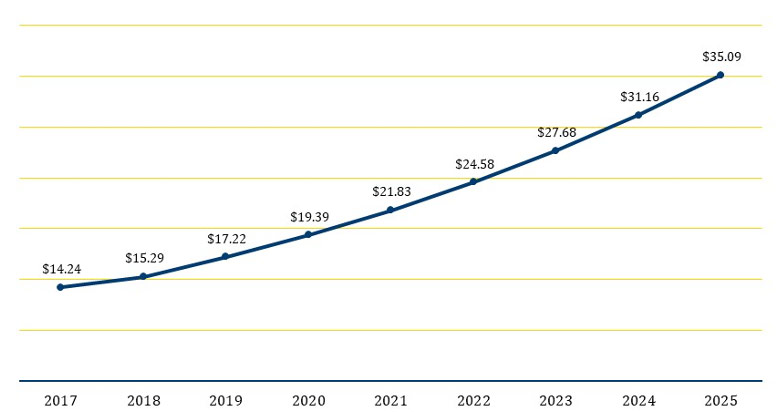

- Real estate is the world’s largest asset class reaching a value of $280.6 trillion at the end of 2017

- Residential real estate accounted for about 78% of this value while commercial real estate accounted for 12% and agricultural and forestry real estate accounted for 10%

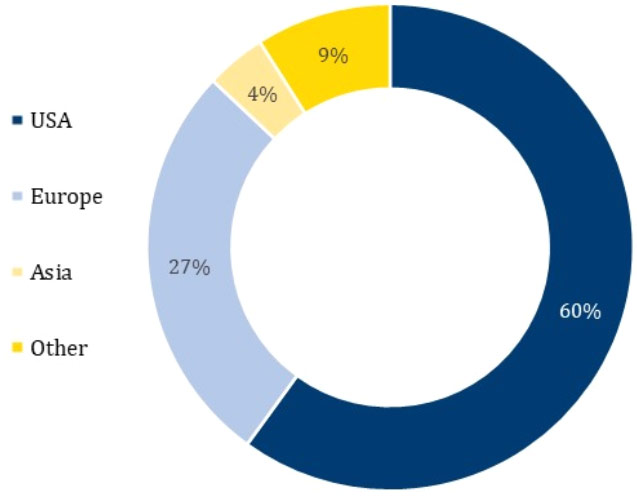

- The United States is the largest market for property technology, as it encompasses nearly 60% of the most prominent companies in the space

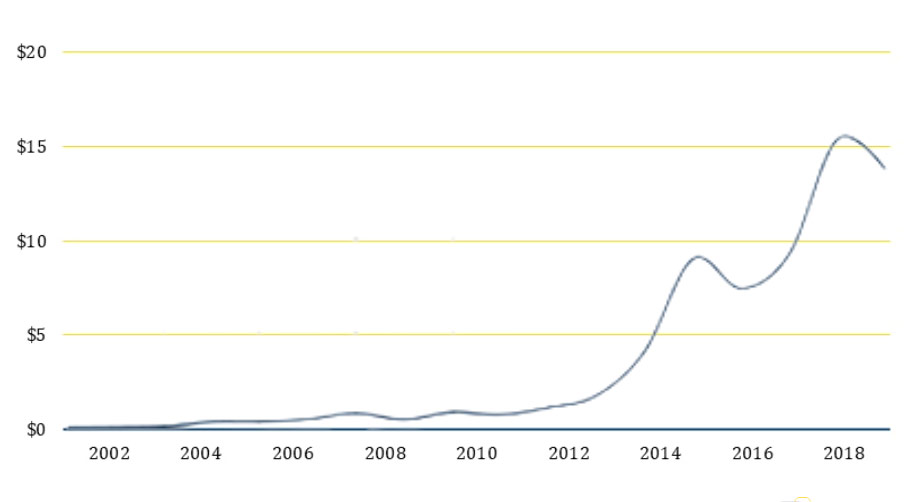

- Private Equities Firms are already increasing activity in this space, as scaling companies get better access to liquidity

World PropTech Distribution

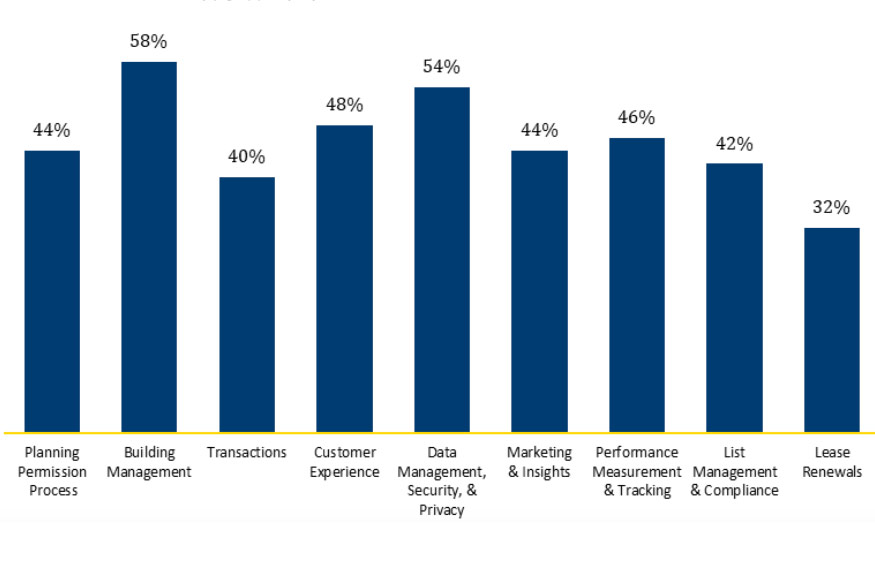

Industry Observations

Key Emerging Trends

- Three key trends that have arisen from COVID-19 are: Flexibility, Safety, and Sustainability

- Virtual walkthroughs have become an industry focus

– This focus has increased innovation in 3D technology, artificial intelligence, anti-fraud and cyber security technology - Sustainable technology in construction and building maintenance will be crucial going forward. Supply chain and cost issues arising from COVID-19 will create a greater focus on sourcing sustainability

- Smart home/ commercial air filtration systems are expected to be on the rise, driven by commercial demand for air safety and public sanitation

- Chatbots and customer-focused AI have become an industry-norm used to maintain high levels of customer satisfaction while also keeping a quick response time. Customer service has seen a shift to a virtual, no contact process

Industry Overview Matrix

How To Use The Matrix:

- Please fill in the grey cells with the % of revenue derived from the specific service offering/Real Estate type provided

- LTM Revenue – Last 12 full twelve-month period of revenue

- Revenue Mix – % split of revenue type – i.e. recurring revenue, transactional revenue, late fees

- Revenue Growth – YoY CARG

- Revenue Diversity – Revenue derived from #1 Client, revenue derived from Top 10 Clients

- Gross Margin/EBITDA Margin – Net Profit Margin is ok too, but will provide less accurate valuation

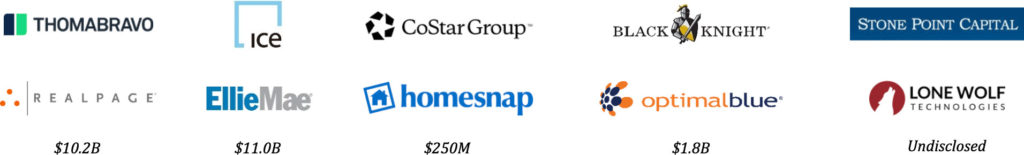

Significant Strategic & Private Equity M&A Transactions 2020

Contact David and Susan Today:

David Kadycz

Associate

- David@TCRES.com

- 804.612.7115

David has been with Transact for three years, starting as an analyst and advancing to associate He has a background in International Commercial Real Estate investments. Prior to joining Transact Capital, David worked for I-Deals LLC, where he was part of an international team, responsible for in-depth evaluations of potential investments for an Israeli- American equity group.

In addition to his experience as an Analyst David brings with him a unique background. Having been born in Israel to Belgian parents, David is fluent in English, French and Hebrew.

David has lived in the U.S for 12 years and was graduated from James Madison University, Magna Cum Laude, in 2018 with a degree in International Business. David has completed both his Series 79 and Series 63.

Check the background of this investment professional on FINRA’s Broker Check.

Susan Clark

Senior Operations Manager

- Susan@TCRES.com

- 804.612.7108

Susan is an Office Manager for Transact Capital with more than 10 years of experience leading teams. Before coming to Transact, Susan was a Director of youth ministries, leading teams and mission trips throughout the east coast. Susan was also a speaker at conferences and advisor to new Directors in the Richmond District. She volunteers her time to Pay it Forward, a nonprofit rehousing homeless people in the Richmond area.

Susan has a Bachelor of Arts degree from Virginia Commonwealth University. She has two daughters and a yellow lab named Finn.